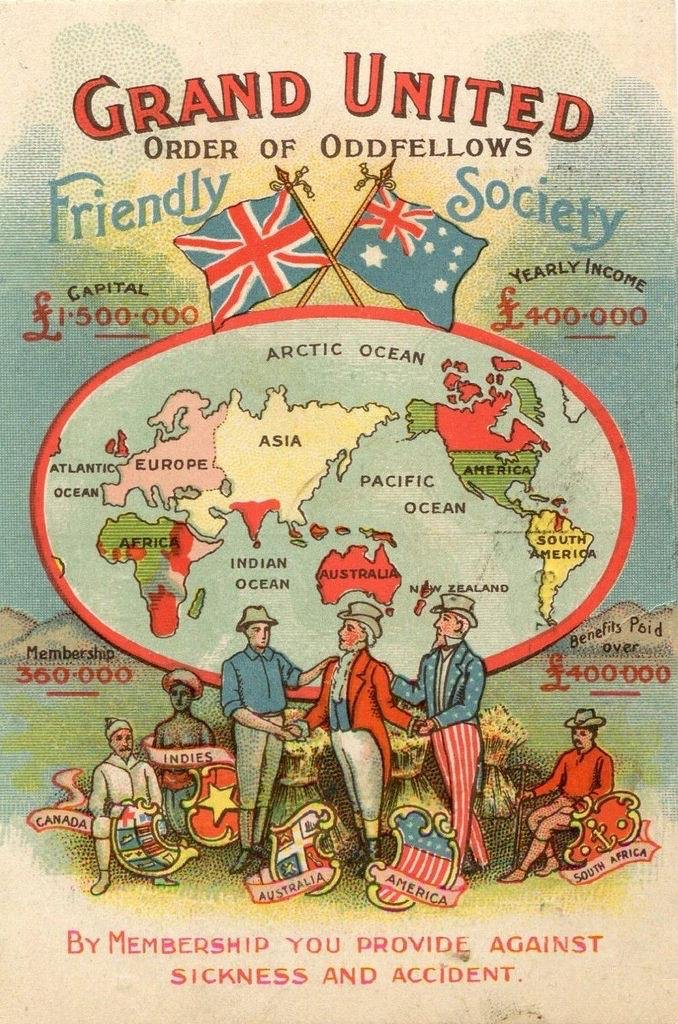

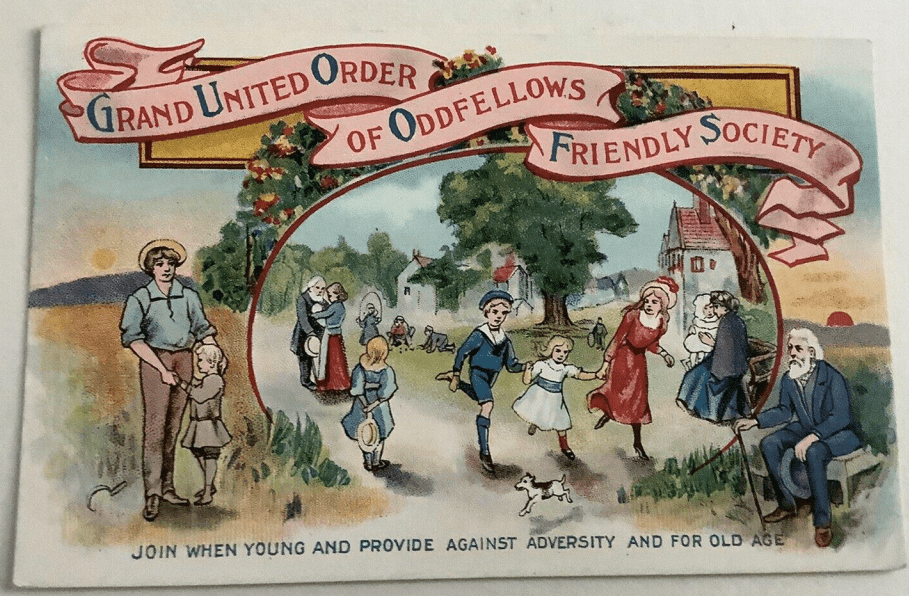

Grand United Order of Odd Fellows

Long ago one of the reasons our Fraternity was one of the biggest was the issuing of member benefits. Lodges provided benefits for Sickness, Death, and Funeral costs. Most Lodges today have not issued benefits in years. There has been discussions lately about changing that. The Harry Marsh Lodge No. 12265 of the Grand United Order of Odd Fellows has issued benefits since its inception over 20 years ago. At first the Lodge issued a modest Death Benefit and a Funeral Benefit. The Funeral Benefit included paying for Flowers and Music for a members funeral. The Death Benefit was a modest cash payment of $200.00 to the family to spend at their discretion. From those modest beginnings the Lodge benefit system for the Harry Marsh Lodge has evolved into a complete benefit package for the members. This Fraternal Benefit plan now includes, Sickness, Prescription Drugs, Health Services, Education, Accidental Death, Funeral, and Standard Death benefits.

The Harry Marsh Lodge does this even though we lease our Lodge Hall that is used exclusively by us, and are located in a small suburb. Annual membership dues are only $50.00. So how do we do it? The current Fraternal benefit plan and structure was instituted in 2011 and has been adjusted and updated 3 times since. These adjustments have been limited to increases in Benefit amounts and the delivery of benefits with the basic structure staying the same. Believe it or not it is not that hard to do. The Lodge back 14 years ago set up a restricted account for the Benefit Program. This account is to be kept at a minimum amount from which to draw benefits, however when the Lodge has extra funds they are directed to this account and if needed to pay regular costs they can be withdrawn as long as the minimum amount is maintained.

Two of the reasons I hear that Lodges do not want to start a benefit program for members is fraud and the high costs to start a program. In the 22 plus years the Harry Marsh Lodge has had a benefit program there has not been one case of fraud or excessive use by any member of the Fraternal benefit program. As a matter of fact in 22 years the number of cases that benefits have been requested or issued is probably under 10. So why doesn’t fraud happen in a Lodge setting. That issue is easily answered the Lodge is not some faceless insurance company it is made up of yourself and your brothers. Also all benefits must be approved by the Lodge in general session and the visiting committee must also insure the benefit is warranted. Associate members are not eligible only full dues paying members are issued benefits. Other safe guards put into place are time restrictions; many benefits are not available until a member has over a year of membership. As to high costs to start a program the Harry Marsh Lodge issues a modest set amount of benefits. No one is going to get “rich” of the benefits we issue. We started our restricted Benefit Account with only a $5,000.00 initial deposit and while it is considerably more now it has never been in jeopardy of running out of funds. There are also restrictions on how many times you can apply for particular benefits. For Instance the Sick Benefit can be only used twice a year, the educational benefit for a members child to further their education can only be used once for each child the member has. The Lodge has also partnered with insurance companies and Health providers to issue some benefits. The Health Services and Accidental Death benefits which cover members and their spouses up to age 70 and any minor children is written in conjunction with an Insurance company with the Lodge paying a modest annual premium per member. The prescription drug coverage is issued in conjunction with a Health Care Company with a similar set up. Again the benefits are modest but they are enough to provide some relief, they actually make a difference, and they give value to membership.

If your Lodge is thinking about starting a benefit program for the members, there are a couple of things to think about. First; start off small. Some targeted modest benefits that present some value to the members. Make sure you have all the correct legal jargon and protections covered in your by-laws. At Harry Marsh we had assistance from a licensed Insurance agent with years of experience to assist us with this and cover all our bases. With 22 years of issuing benefits behind us the Harry Marsh Lodge can clearly say that Fraternal Member Benefits can be issued in the Modern World and still have a place in the Modern Odd Fellows Lodge.

Want to more about the Odd Fellows? Ask Me I May Know!

Visit our Facebook page: Heart In Hand

Fine idea for the members.

Always thought groups should leverage their numbers to help others and the members.

LikeLike